indiana estate tax return

Inheritance tax was repealed for individuals dying after December 31 2012. 31 2012 every resident estate or trust having gross income or.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

. Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill out. Indiana has neither an estate tax a tax. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Indiana estate tax.

Many of the necessary. Preparation of a state tax return for Indiana is available for 2995. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

The final income tax. Find Indiana tax forms. Know when I will receive my tax refund.

E-File is available for Indiana. All district offices have hours from 8 am. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

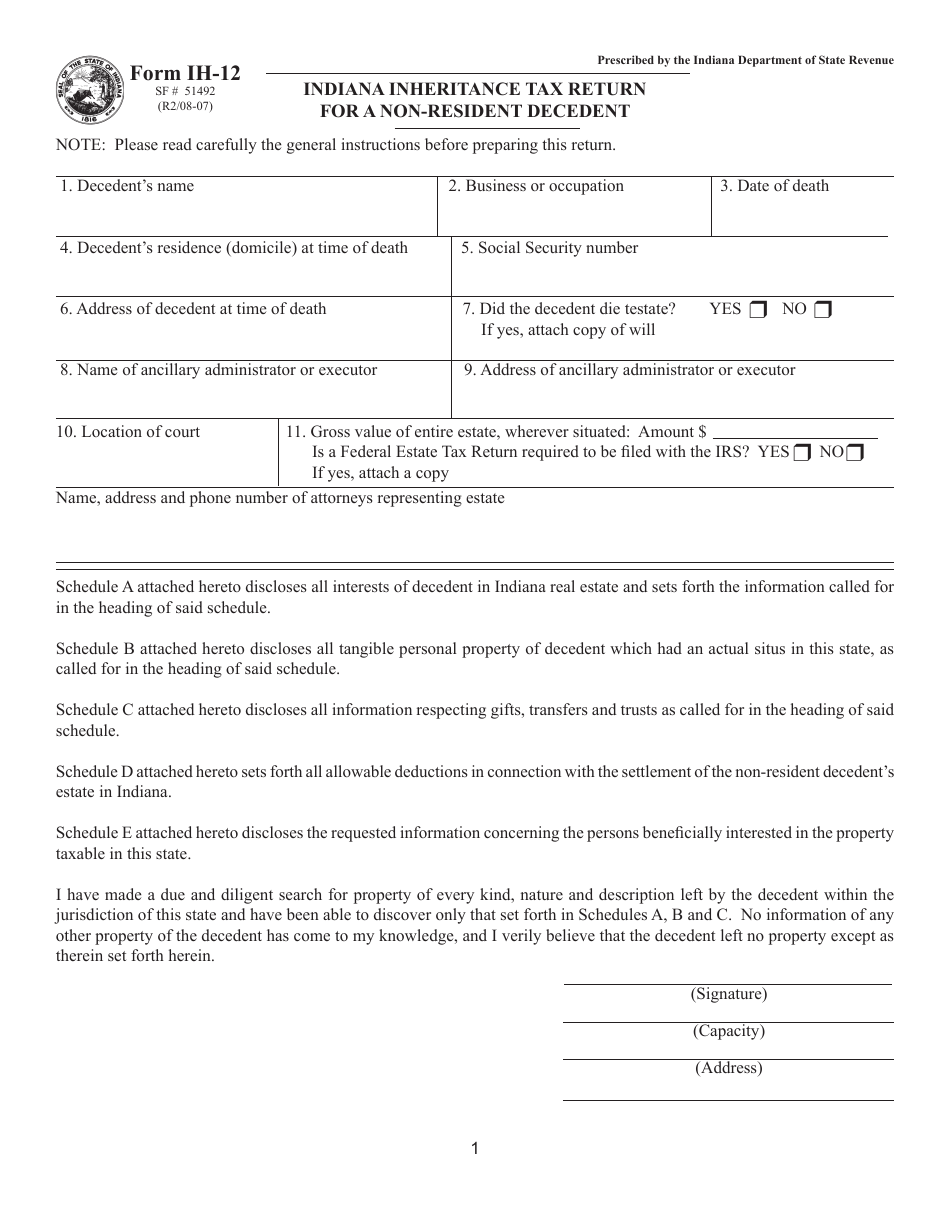

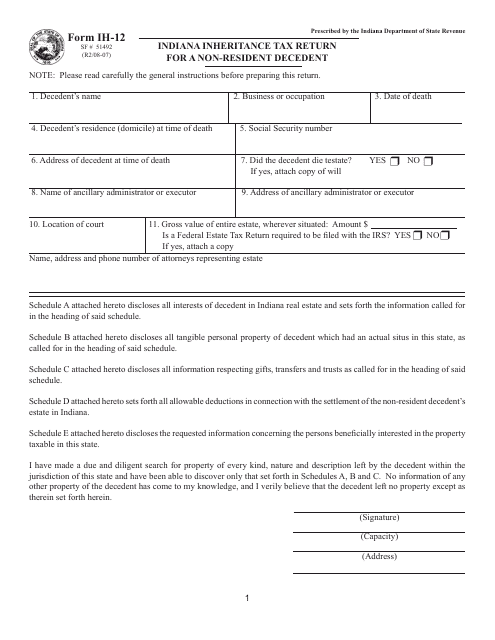

According to IC 6-3-4-1 and for taxable years beginning after Dec. Direct Deposit is available for Indiana. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

These taxes may include. 31 rows Generally the estate tax return is due nine months after the date of death. Indiana state income tax withholding calculator also takes into account any tax that a county may imposeThis is because the state of Indiana has a flat tax rate at 323 rate.

Contact a district office of the Indiana Department of Revenue see Resources. The types of taxes a deceased taxpayers estate. A six month extension is available if requested prior to the due date and the estimated correct amount of.

Most estates and trusts file Form 1041 at the federal level and file Form IT-41 at the Indiana level. To 430 pm Monday through Friday with the exception of major. The Internal Revenue Service IRS requires estates to exceed 114 million to file a federal estate tax return and pay estate tax.

Up to 25 cash back That process outlined in Indiana Senate Bill 923 will take ten years completely eliminating the tax in 2022. Just one return is filed even if several inheritors owe. Estate or a trust is sometimes referred to as a pass-through entity.

Because the tax being assessed is only on the. Calling 1-800-TAX-FORM 800 829-3676.

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Indiana Inheritance Tax Free Download

Estate And Income Tax Liabilities For A Sample Of Estate Tax Decedents Download Table

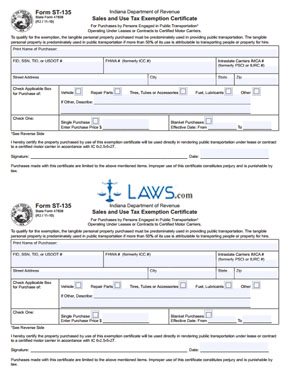

Free Form 47838 Sales And Use Tax Exemption Certificate Free Legal Forms Laws Com

Estate And Gift Tax Planning Wolters Kluwer

Indiana Estate Tax Everything You Need To Know Smartasset

How Indiana Probate Law Works Probate Advance

Estate And Inheritance Taxes By State In 2021 The Motley Fool

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller

Wills Trusts Estates Prof Blog

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Transfer On Death Tax Implications Findlaw

Indiana Gazette From Indiana Pennsylvania On June 5 1999 Page 50

Indiana Estate Tax Everything You Need To Know Smartasset

Death And Taxes Nebraska S Inheritance Tax

How To Transfer Property In Indiana Pdf Free Download

Indiana Petition To Waive Filing Of Inheritance Tax Return Us Legal Forms

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys